It’s Time to Move from your Mom’s Basement

HomeOwnership and Wealth

When it comes to homeownership and wealth accumulation, there is a vast difference between renters and owners. It’s Time to Move from your Mom’s Basement!

Are you still renting or living at home and wondering about your next big step? If homeownership seems like an unattainable dream, then read on. We’ll explore compelling data showcasing the vast wealth accumulation differences between renters and homeowners and provide practical steps to make this significant life change.

If you want to buy or sell a home, contact Kelly Ettrich for help with your real estate journey.

The Homeownership Advantage

The gap in wealth accumulation between renters and homeowners is not just significant—it’s astounding. Homeownership is a formidable step toward financial stability and building a future. But what makes it such a powerful wealth-building tool? Let’s break down the numbers and see the advantages of owning your home.

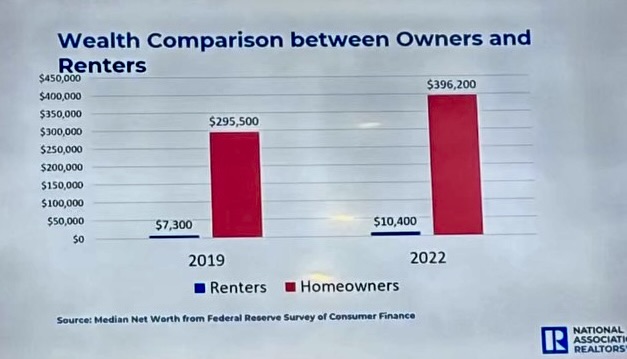

The chart above illustrates the difference that homeownership and wealth create. “Wealth Comparison between Owners and Renters.” In 2019, renters have a median net worth of $7,300, while homeowners have a significantly higher median net worth of $295,500. In 2022, the disparity widened further, with renters at a median net worth of $10,400 compared to homeowners at $396,200. That difference is the accumulation in value based on the value of homes appreciating.

On average, home prices increase from 3 – 5% per year. Home prices have risen for 11 consecutive years, with 2021 seeing the highest jump at over 18%. Nationally, in 2022, the median sales price of existing single-family homes reached roughly $393,000, increasing by around $36,000 from the previous year. As of July 2023, the Freddie Mac House Price Index (FMHPI) measured an increase of 2.88 percent compared to the year before. In December 2023, house prices grew 6.4% year-over-year. If you look at Loudoun County, Virginia, the average home value is $763,046, up 5.9% over the past year and will be pending in around five days. The trend in home prices is expected to continue; even with higher interest rates, the supply of homes continues to be lower than market demand.

This continued housing market strength is why “It’s Time to Move from Your Mom’s Basement.” If you live at home or rent, plan to become a homeowner. Try out these following steps:

Steps to Becoming a Homeowner

Transitioning from a renter to a homeowner may seem daunting, but with the proper preparation, it’s entirely feasible. Here are the essential steps:

- Get Pre-qualified – Understanding your budget and what you can afford is the first step toward finding your new home.

- Explore First-time Buyer Programs – Numerous programs assist first-time buyers with down payments and closing costs.

- Plan Your Finances – A clear and structured financial plan can set you up for a successful home purchase.

Also, contact Kelly Ettrich; she can advise you along your first-time buyer journey.

Conclusion

Homeownership is a rewarding investment that offers a place to call your own and contributes significantly to your financial portfolio. If you’re ready to take the step from renting to owning, the time to start planning is now. Equip yourself with knowledge, explore your options, and prepare to make one of your life’s most empowering financial decisions.